On a hot sunny afternoon, a young boy from a refugee camp in Malawi takes a break (by Daniel Mtombosola)

Not all of those who wander are lost.

- J.R.R. Tolkien

Every year, tens of millions of people are forced to leave their homes. Not because of war or politics, but because the climate no longer allows them to stay. In 2024 alone, weather-related disasters triggered 45.6 million internal displacements, the highest number ever recorded since monitoring began in 2008. The rains don't come. The rains don't come. The crops wither. Rivers rise. Storms return stronger. For those who must move, insurance is rarely even a consideration.

Traditional insurance was never built for people without property. No title deed, no payout. No fixed address, no policy. The risks faced by climate migrants are real and severe: lost income, destroyed shelter, sudden exposure to new weather extremes. As movement becomes the primary adaptive strategy for millions, we need to rethink what insurance can be and who it's for.

At Suyana, we're asking: Can protection travel with you?

1 / The Coverage Gap No One Talks About

Climate displacement is accelerating. Internal and cross-border migration tied to weather shocks now affects millions annually. Traditional insurance systems leave these people completely unprotected. With no collateral, no formal residence, and often no access to banking, climate migrants are shut out of safety nets designed to help people manage risk.

This isn't an edge case. This is the future of climate adaptation. There's a $300 billion annual protection gap that leaves the world's most vulnerable with nowhere to turn when disaster strikes.

Parametric insurance offers a promising alternative. This model pays out based on objective triggers like rainfall levels, vegetation indices, or flood thresholds. Instead of waiting for damage assessments and claims processing, parametric coverage can deliver rapid, transparent payouts within days of a trigger event. The challenge? Making it work for people without addresses, assets, or formal documentation.

We're working to solve exactly that.

2 / How Mobile Protection Actually Works

Imagine a drought hits southern Malawi. Satellite data confirms rainfall has dropped below critical thresholds. Within 72 hours, funds flow, not to individual policyholders scrambling with paperwork, but to trusted local organizations who can immediately reach displaced families with cash assistance.

This is already happening. In August 2023, the United Nations Refugee Agency (UNHCR) received a $400,000 payout through the African Risk Capacity Replica program, protecting 4,000 refugee and host-community households in drought-stricken Dowa District. No claims forms. No proof of ownership. Data-driven support when people needed it most.

[Map of Malawi payout or infographic of how payout flow works]

UNHCR receives a payout from the African Risk Capacity Group to protect refugees in Malawi

Innovative parametric approaches are being designed for displaced populations in several ways:

-

Regional Protection Zones: When climate triggers are hit in a specific area, payouts support everyone affected there. Refugees, migrants, and host communities alike. Coverage follows crisis zones rather than individual policies.

-

Early Warning Support: Forecast-based mechanisms can release funds before displacement occurs, allowing families to migrate safely or secure temporary income. The African Risk Capacity program has already covered 1.2 million vulnerable people across multiple countries using this approach.

-

Embedded Coverage Networks: By integrating parametric protection into refugee registration systems, migrant support networks, or cooperative structures, coverage reaches people without requiring formal documentation. Organizations people already trust become the delivery channel.

The result? Rapid liquidity when it matters most, extending financial protection to those traditional systems ignore.

3 / Designing With Dignity

Climate risk doesn't discriminate, but access to protection often does.

For parametric insurance to serve people on the move, it must be built on more than data and algorithms. It must be built on dignity. That means going beyond payout speed or technical precision to ask harder questions: Do people understand when and how they're covered? Can they trust a system they've never encountered before? Does the product fit their reality, or someone else's idea of it?

Dignity-centered design in practice:

-

Radical transparency: When a payout depends on rainfall or soil moisture, the logic must be visible. Visual dashboards, SMS updates, and community awareness campaigns help users feel included in the system, not subject to it. In Zimbabwe, the ARC Replica program showed how community education around rainfall triggers built both understanding and trust.

-

Mobile-first, documentation-light: Displaced people often lack formal ID or credit history. Pilots across Kenya, Uganda, and Bangladesh have shown that biometric registration or digital tokens can expand access without bureaucratic barriers. In Fiji, a 2023 micro-insurance pilot using rainfall and cyclone triggers included field-level verification before disbursement. The result: 50% women and 37% persons with disabilities among 535 beneficiaries. Intentional inclusion works.

-

Trusted intermediaries: Migrants are more likely to engage through NGOs, cooperatives, or community health workers than formal insurers. Designing products that flow through these channels—and letting them co-design communications—builds both reach and legitimacy.

Dignity isn't a feature. It's the foundation. When insurance is designed well, it offers more than money. It offers fairness, predictability, and a signal that someone saw the storm coming and chose to care.

4 / What Comes Next

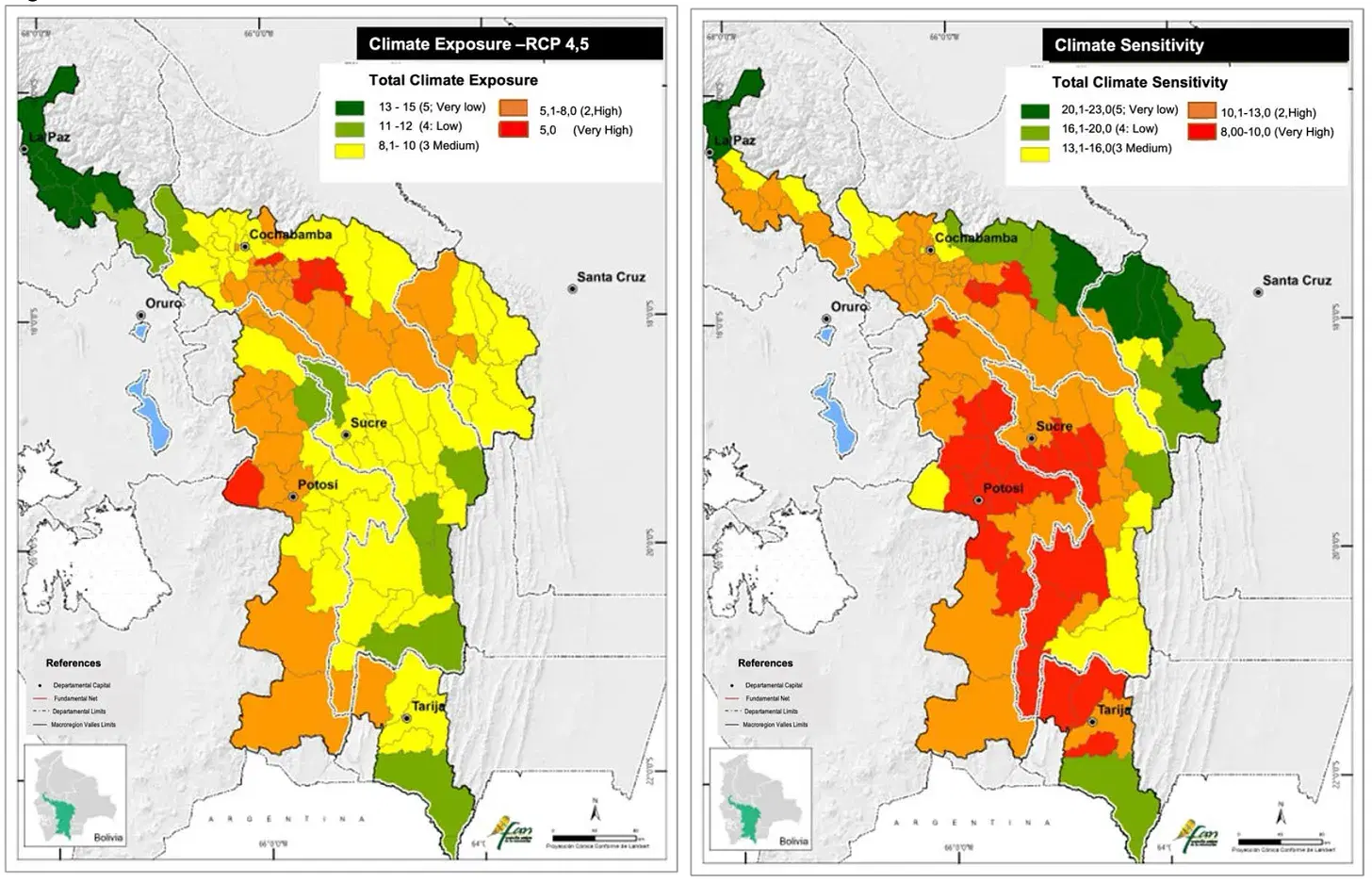

At Suyana, we've always believed that resilience shouldn't depend on geography or paperwork. That's why in Bolivia, we're launching our first Early Warning System combining satellite forecasts, mobile alerts, and embedded parametric insurance for smallholder farmers. But we're learning something broader: climate shocks ripple beyond the farm, touching families in motion as they seek work, shelter, or safety in new regions.

Climate Exposure and Sensitivity to Climate Change in the Valle’s Regions. Source: UN FAO (2024)

We're now working with local partners to explore:

- Mobile-first coverage that reaches people without formal land titles or fixed locations

- Trigger designs based on regional climate thresholds and displacement patterns

- Distribution via cooperatives, municipal shelters, and migrant support networks

We know that protecting the most vulnerable requires rethinking how coverage is priced, delivered, and explained. This isn't just ethical. It's where the future of adaptation finance must go.

We're actively seeking collaborators working at the intersection of displacement, digital infrastructure, and adaptive finance across Latin America. If you're building tools for migrants, working in disaster response, designing cash transfer systems, or operating refugee support networks, we want to talk.

As climate migration accelerates, the world will need new forms of safety. Faster, fairer, and more flexible. At Suyana, we believe parametric insurance can be one of them. Not because it's perfect, but because it can be predictable, transparent, and designed with dignity.

And dignity should travel too.

Further reading:

- 2025 Global Report on Internal Displacement, Internal Displacement Monitoring Centre (IDMC), 2025

- Climate change and migration: Links, evidence and implications, PMC National Center for Biotechnology Information, 2021

- Climate displacement is accelerating worldwide, Nature Cities, 2024

- Southern Africa Operational Update, UNHCR, 2024

- Parametric solutions for climate migrants in East and Horn of Africa, International Organization for Migration (IOM), 2023

- Breaking new ground: Climate insurance solutions for refugees and host communities in Africa, CGIAR, 2023

- Early positive impact of parametric insurance shows the way forward, UN Capital Development Fund (UNCDF), 2023

- Watchbirds of the Valles, Suyana Newsletter, 2025